Are Mortgage Rates Finally Coming Down for Good?

ou want mortgage rates to fall — and lately, they’ve started to. 🙌 But the real question is: will it last? And how low could they go?

Experts say there’s still room for rates to come down more over the next year. One of the biggest indicators to watch? The 10-year Treasury yield. Here’s why that matters for homebuyers and sellers.

💡 The Link Between Mortgage Rates and the 10-Year Treasury Yield

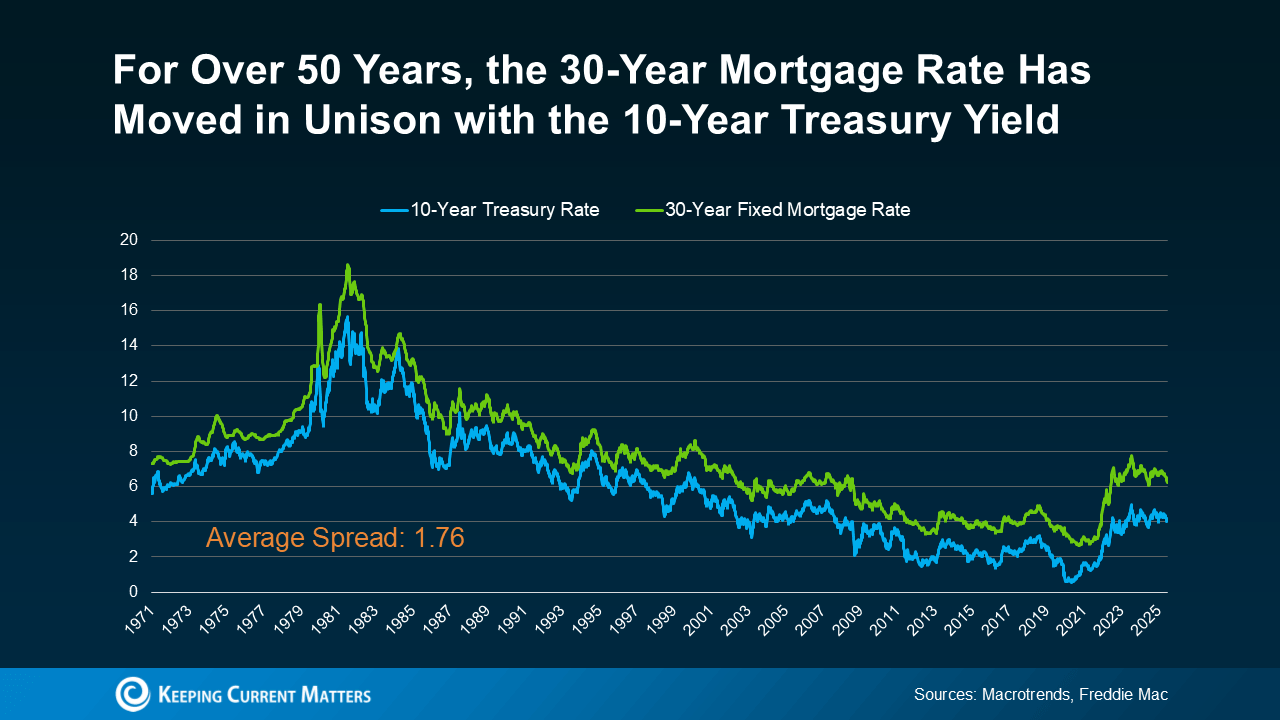

For over 50 years, the 30-year fixed mortgage rate has closely followed the 10-year Treasury yield, a key benchmark for long-term interest rates.

📊 When the yield rises, mortgage rates usually go up. When it falls, mortgage rates typically come down.

That relationship has been consistent for decades. The difference between the two is known as the spread, which normally averages about 1.76 percentage points (or 176 basis points).

📉 The Spread Is Shrinking — And That’s Great News!

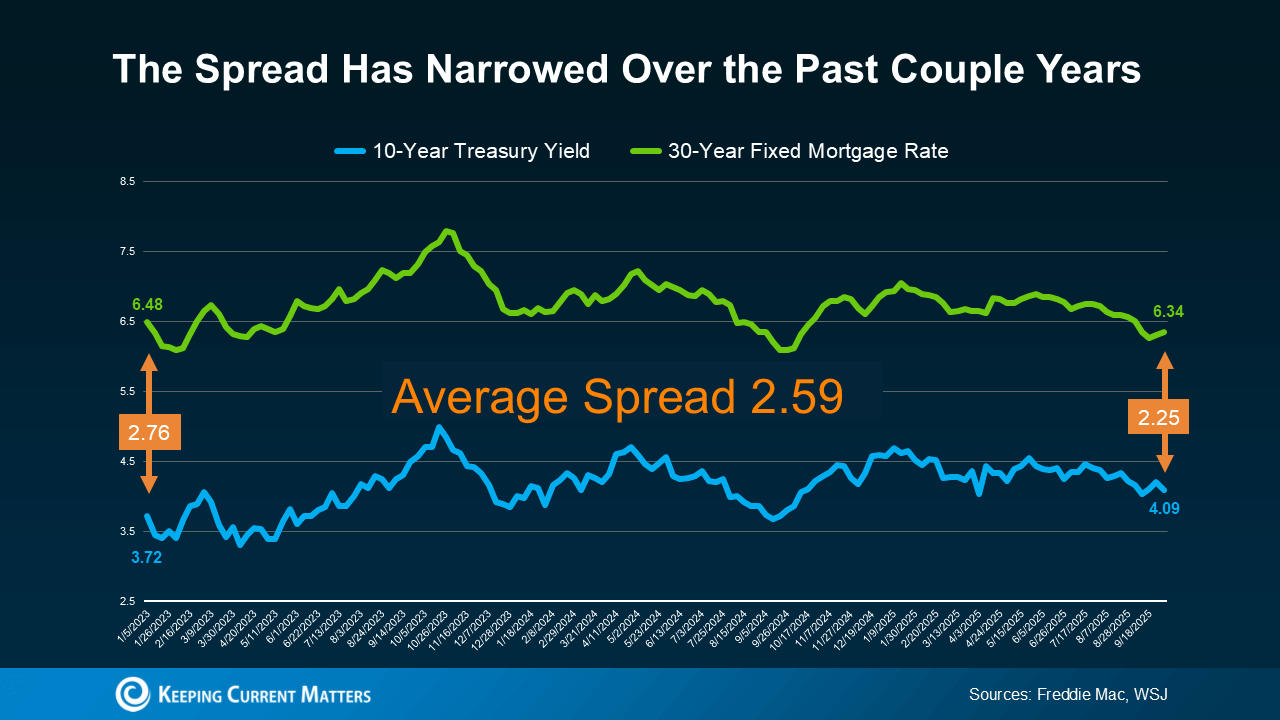

In the past couple of years, that spread has been wider than usual due to economic uncertainty. The wider the spread, the higher mortgage rates tend to stay.

But here’s the good news — that spread is finally narrowing as the economic outlook becomes clearer. And that’s helping mortgage rates move lower.

As Redfin explains:

“A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

📊 The 10-Year Treasury Yield Is Expected To Decline

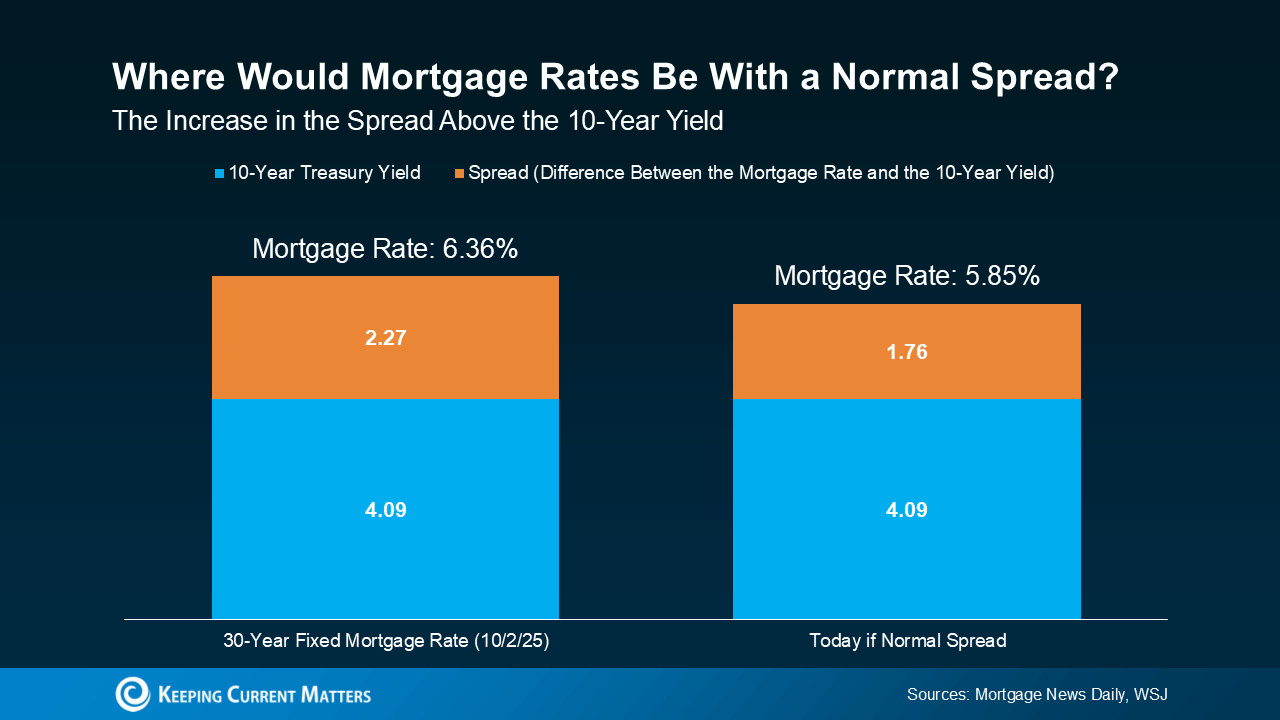

It’s not just the spread shrinking — the 10-year Treasury yield itself is forecast to come down, too.

When you combine a lower yield with a narrowing spread, both factors point toward more potential mortgage rate drops going into 2026.

Right now, the 10-year yield is around 4.09%. Add the average spread of 1.76%, and that suggests mortgage rates could reach around 5.85% toward the end of next year — if trends continue.

Of course, rates can still fluctuate with the economy, inflation, and job market shifts. But overall, the outlook is encouraging. 🌟

🏡 Bottom Line

Keeping track of all these factors can feel overwhelming, but that’s where a trusted professional comes in.

📞 Call Krista Klause, your trusted Realtor serving San Antonio, Helotes, Bandera, and surrounding areas. I’ll help you stay on top of market changes, understand what lower rates mean for you, and make your next move with confidence.

Categories

Recent Posts