Renting vs. Owning: Why Your Future Self Will Thank You for Buying

When you rent, your monthly payment goes straight to your landlord. At the end of your lease, you walk away with your memories—but not with any financial benefit from all those payments.

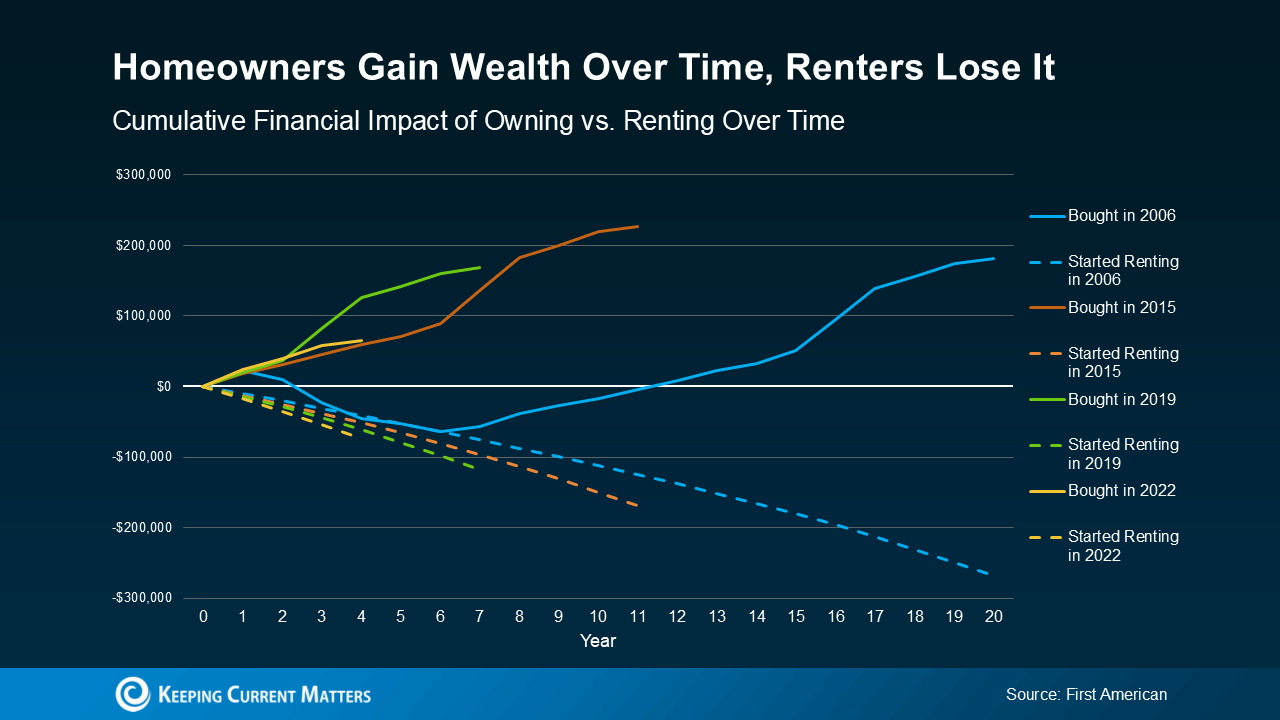

When you own, a portion of each mortgage payment builds equity, which is your ownership stake in the home. Over time, as you pay down your loan and your home potentially appreciates, that equity can become one of your biggest financial assets. That’s the key difference:

-

Renting = short-term convenience, no long-term stake

-

Owning = more responsibility, but long-term wealth-building potential

Across different time periods—whether during the housing bubble, before the pandemic, or in recent higher-rate years—studies keep showing the same pattern: over the long run, homeowners build net worth while renters do not. The longer you own, the more that gap usually widens.

Time in a Home Builds Wealth ⏳🏦

Owning isn’t always cheaper month-to-month in the beginning. You’ll likely have a down payment, closing costs, and ongoing maintenance. But as the years pass, more of your payment goes toward principal, and your home’s value can grow. That’s how homeowners often end up ahead financially—even after factoring in repairs, insurance, and taxes.

Renters, on the other hand, keep paying more over time without gaining an asset. Rents can rise, leases renew, and at the end of each year, there’s still no equity in your name.

Good News: Affordability Is Slowly Improving 📉🙂

You might still feel like buying is out of reach—and given the last few years, that’s understandable. High rates and fast price growth have made it tough. But things are beginning to shift:

-

Mortgage rates have eased from their recent peaks.

-

Home price growth has cooled in many areas.

-

Incomes have inched up, helping monthly budgets a bit.

In many markets, typical monthly payments today are slightly more manageable than they were a year ago. It’s not a dramatic change, but it’s enough to move some buyers from “no way” to “maybe we can.” Over time, those small improvements can be the difference between staying a renter and taking the first step into homeownership.

Bottom Line: Rent Feels Easier, Owning Builds Wealth 🧠➡️💰

Renting might feel less stressful today, but owning is what tends to build real wealth over time. As affordability edges in a better direction, the path from renting to owning may be more open than you think.

If you’re curious what buying could look like for you—your monthly payment, down payment options, or how long you’d need to stay for it to make sense—talk with a local expert who can walk you through it, step by step.

For friendly, pressure-free guidance in San Antonio, Bandera, Helotes, and surrounding areas, call Krista Klause, your trusted realtor, and start exploring how to turn your rent into equity. 🏡📲

Categories

Recent Posts