Mortgage Rate Stability Might Be the Opportunity You’ve Been Waiting For!

Over the past few years, affordability has been one of the biggest challenges for homebuyers 😩. With rapidly rising home prices 🏠 and higher mortgage rates 📊, many folks have felt caught between a rock and a hard place.

But guess what? There's finally some good news! 🎉 While affordability is still tight, mortgage rates have started to show signs of stabilizing – and that could make planning your next move a whole lot easier 😌.

📊 Mortgage Rates Have Stabilized – For Now

Over the past year, mortgage rates have been all over the place – up ⬆️, down ⬇️, and back again. That unpredictability made it tough for buyers to feel confident.

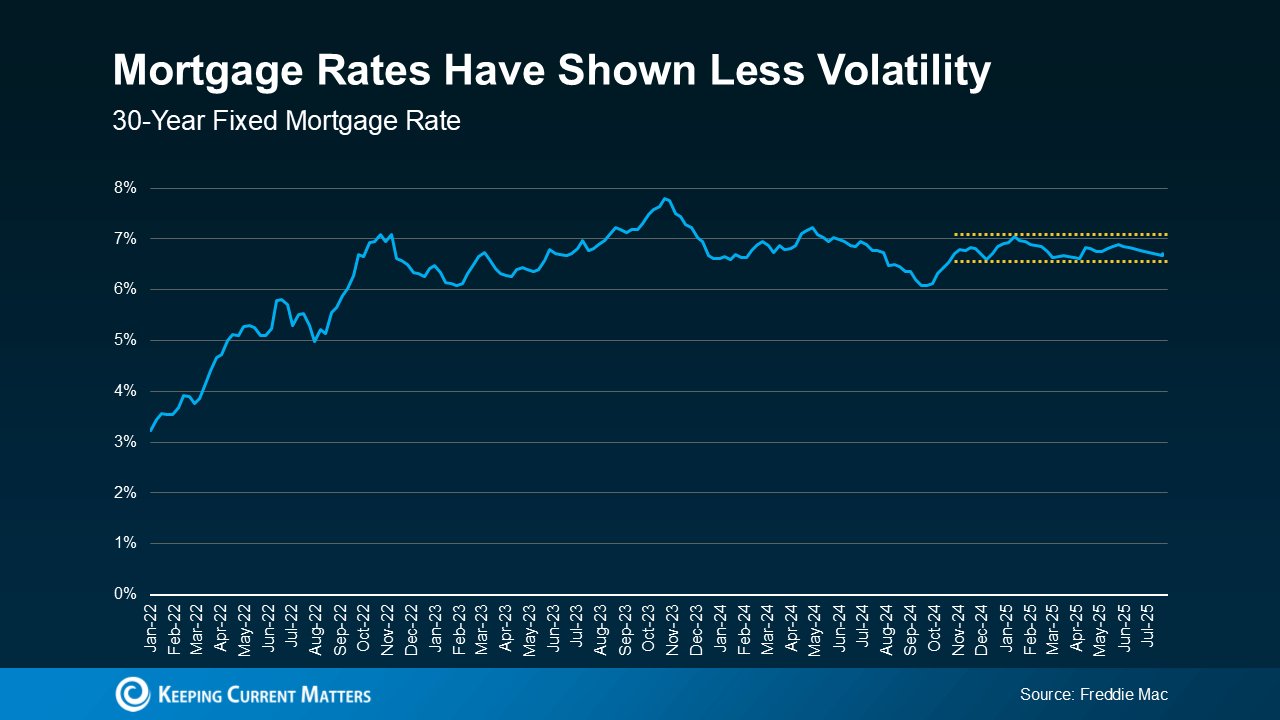

But recently? Rates have started to level out and settle into a more narrow range. ✅ As the chart shows (👀), they’ve hovered within about a half-percentage point since late last year. That kind of calm is something the industry hasn’t seen in a while!

As HousingWire explains:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most ‘calm’ periods for mortgage rates in recent memory.” 🧘♀️

🔮 Will This Stability Last?

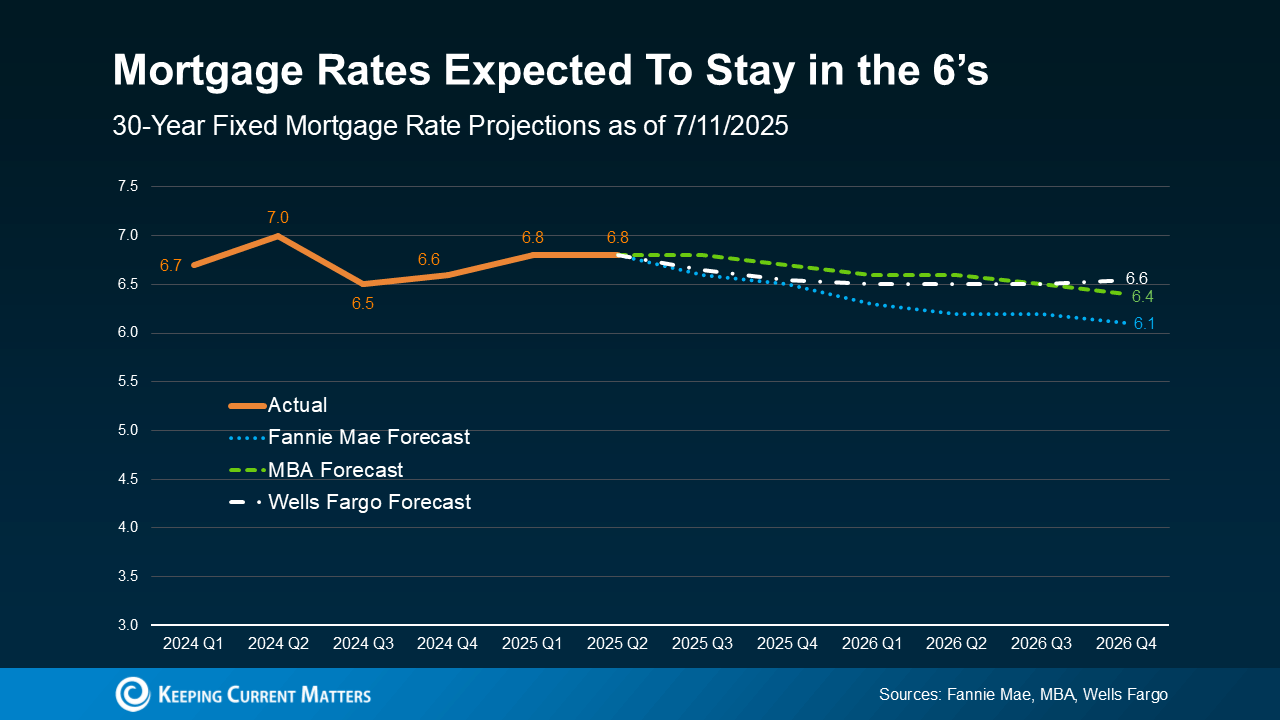

Experts believe this calm might stick around a little longer. Rates could gradually trend downward 📉, but don’t expect any drastic changes overnight.

As Danielle Hale, Chief Economist at Realtor.com, explains:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

Trying to wait for the “perfect” mortgage rate? 😕 You may be better off locking in something solid now than trying to time the market.

🏦 Jeff Ostrowski, Housing Market Analyst at Bankrate, puts it best:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

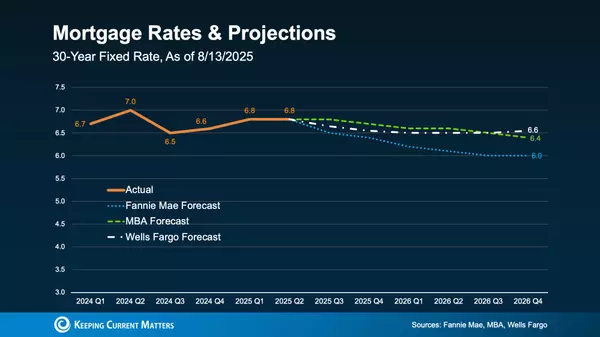

📅 Even forecasts that look out to the end of 2026 say the same thing: Most expect rates to stay in the mid-6% range – right around where they are now.

✅ What This Means for You

This puts today’s buyers in a stronger position 💥. As Sam Khater, Chief Economist at Freddie Mac, says:

“Mortgage rates have moved within a narrow range for the past few months... Rate stability, improving inventory and slower house price growth are an encouraging combination.”

📌 Just keep in mind – mortgage rates can still respond to inflation, economic shifts, and more. But for now, we’re in a window of opportunity 🪟 where things are calmer, more predictable, and possibly more affordable than you might think.

Categories

Recent Posts