Mortgage Rates Are Shifting – What Buyers and Sellers Need to Know

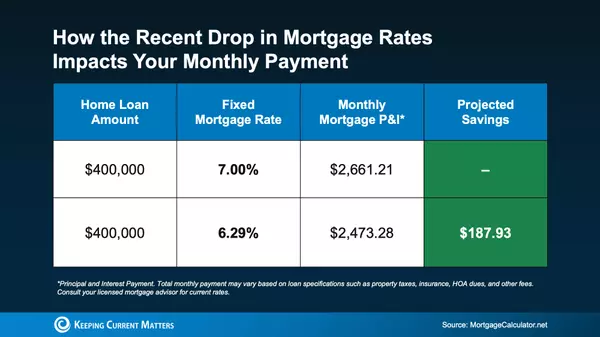

Mortgage rates are still a hot topic – and for good reason. After the most recent jobs report came out weaker than expected, the bond market reacted almost instantly. As a result, in early August mortgage rates dropped to their lowest point so far this year (6.55%).

While that might not sound huge, for buyers who have been waiting for relief, even a small drop creates renewed hope that rates are finally on their way down. But the big question is: what’s realistic to expect next?

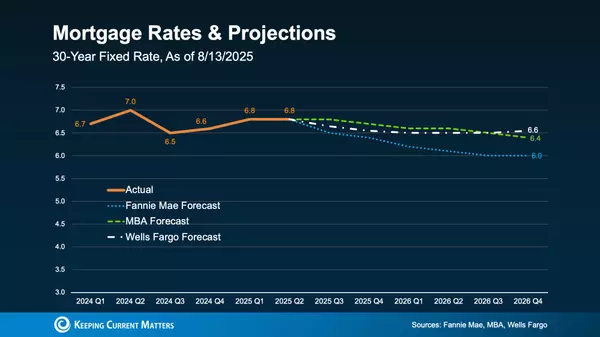

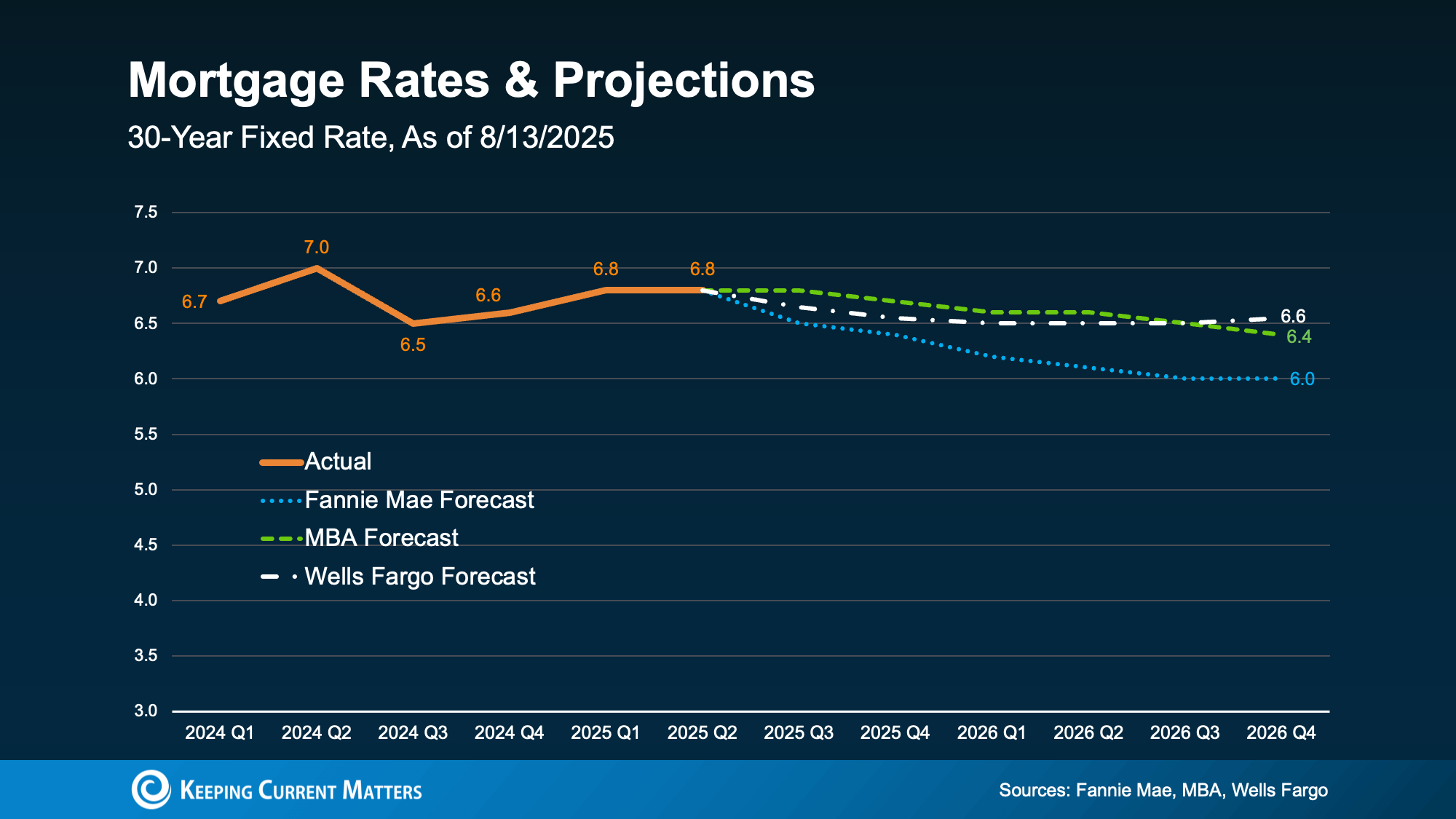

🔮 What Experts Are Forecasting

According to the latest industry forecasts, mortgage rates aren’t expected to fall dramatically anytime soon. Most experts project they’ll remain in the mid-to-low 6% range through 2026.

👉 Translation: don’t expect a return to 3% or 4% rates. But smaller shifts, like the one we just saw, are still likely. Each time new economic or inflation data comes out, mortgage rates may adjust. With more reports scheduled this week, we’ll soon have a better idea of where things are heading.

💡 What Rate Would Get Buyers Moving Again?

The “magic number” most buyers are watching for is 6%. And it’s not just a psychological benchmark—it’s backed by real numbers.

According to the National Association of Realtors (NAR):

-

At 6%, 5.5 million more households could afford the median-priced home.

-

About 550,000 people would buy a home within 12–18 months.

That’s a lot of pent-up demand just waiting for the green light. And forecasts show we may reach that threshold in the near future.

But here’s the tradeoff…

⚖️ Should You Wait for 6%?

If you’re waiting for mortgage rates to hit 6%, remember—you’re not the only one. Many other buyers are waiting too.

When rates drop to that level, you could face:

-

More competition

-

Fewer choices

-

Rising home prices

Right now, however, the market looks very different:

-

Inventory is up → more homes to choose from 🏡

-

Price growth has slowed → more realistic pricing 💰

-

Negotiation power is stronger → better deals possible 🤝

NAR explains it like this:

“Buyers who are holding out for lower mortgage rates may be missing a key opening in the market.”

✅ Bottom Line

Mortgage rates aren’t expected to hit 6% this year, but when they do, the floodgates of buyer demand could open. That means more competition, fewer opportunities, and higher prices.

The unique window of opportunity is already here—less pressure, more options, and room to negotiate.

I’m Krista Klause, your trusted San Antonio realtor, and I’m here to guide you through today’s market, whether you’re buying your first home or considering selling.

📲 Let’s connect today and talk about your options before the market heats up again.

Categories

Recent Posts