Will the Fed’s Next Move Lower Mortgage Rates?

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But does that mean mortgage rates will fall too? Let’s clear up the confusion.

🤔 The Fed Doesn’t Directly Set Mortgage Rates

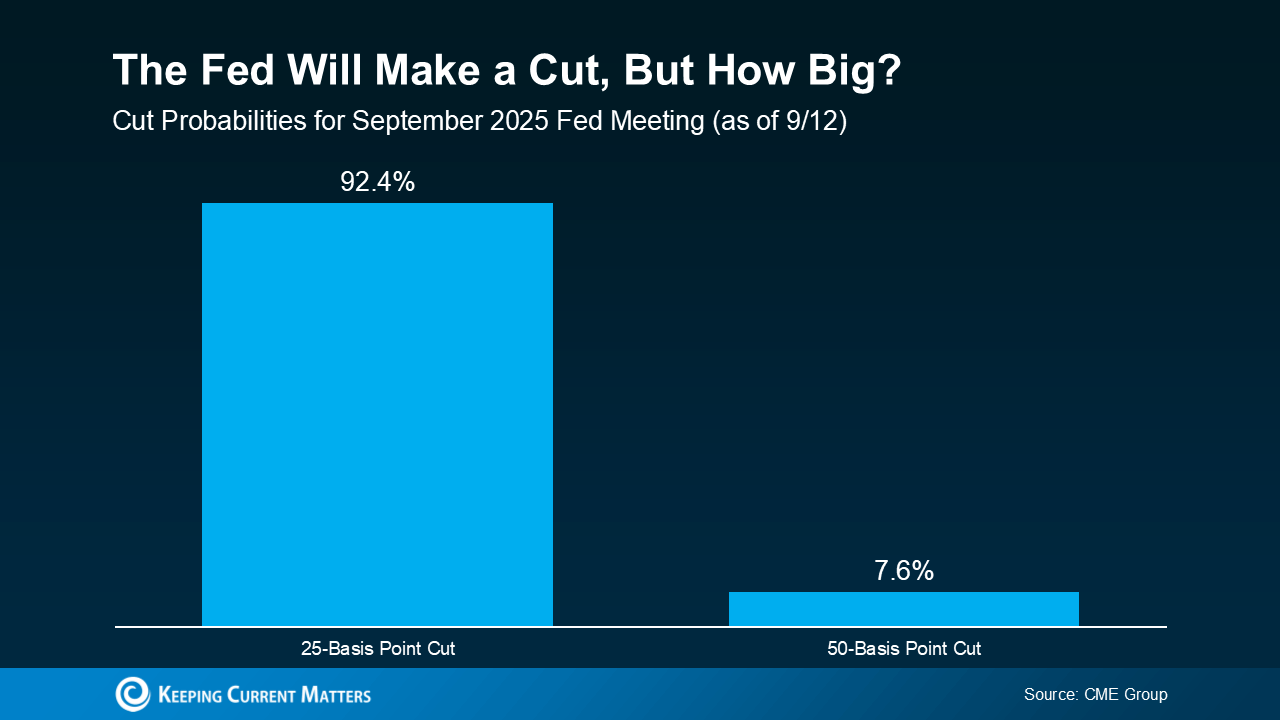

Right now, all eyes are on the Fed. Most economists expect a rate cut at their mid-September meeting to try to cool the economy and prevent a recession.

👉 Here’s the key: the Federal Funds Rate is the short-term rate banks charge each other—not the same thing as mortgage rates. Still, the Fed’s actions can shape where mortgage rates head next.

📊 Why Markets Already Expected This Cut

Mortgage rates often respond to what markets think the Fed will do—before the Fed acts.

-

After weaker jobs reports in August and September, mortgage rates ticked down because investors were confident a cut was coming.

-

If the Fed cuts by the expected 25 basis points, it may already be priced into today’s rates.

-

But if they go bigger with a 50 basis point cut, mortgage rates could move lower than they already have.

🔮 Where Do Mortgage Rates Go from Here?

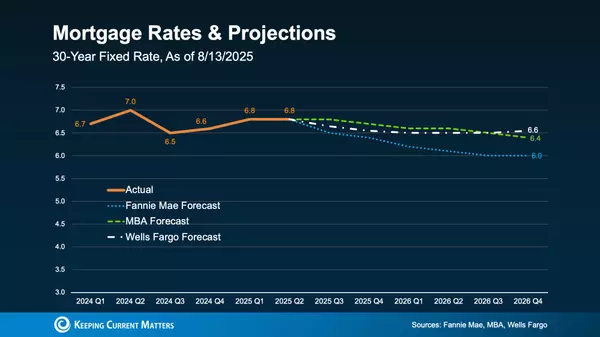

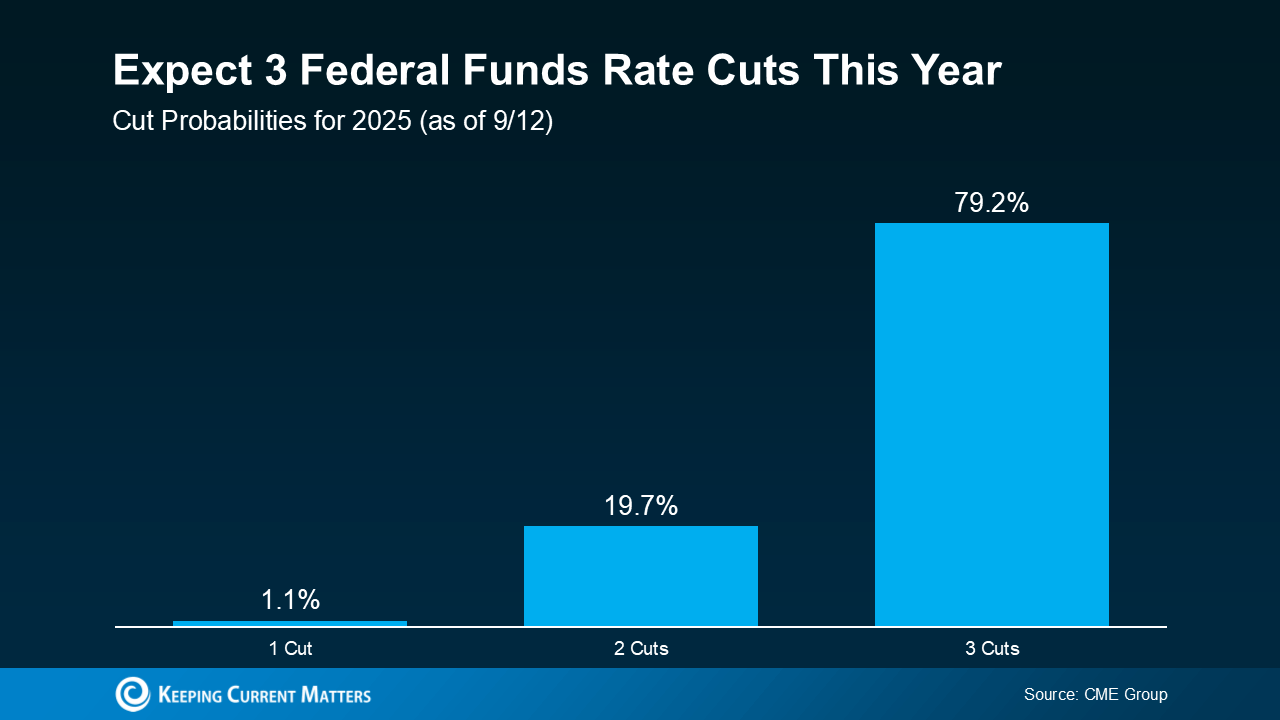

Economists believe the Fed may cut rates more than once before the end of the year. If that happens—or if markets simply expect it—mortgage rates could trend lower through late 2025 and into 2026.

As Sam Williamson, Senior Economist at First American, explains:

“For mortgage rates, investor confidence in a forthcoming rate-cutting cycle could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability and potentially helping to boost buyer demand and overall market activity.”

That means while rates won’t fall overnight, they may slowly ease—giving buyers more breathing room.

✅ Bottom Line

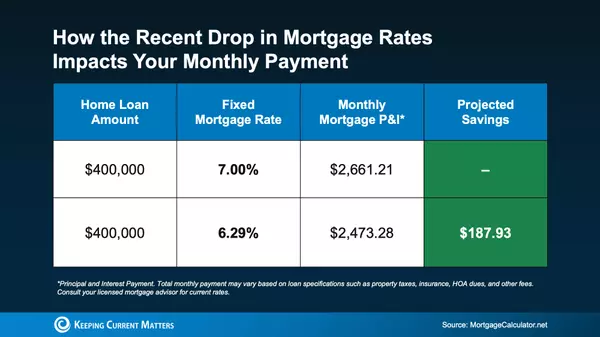

Mortgage rates don’t follow the Fed’s moves one-for-one, but cuts to the Federal Funds Rate can help ease borrowing costs over time.

If you’ve been waiting for affordability to improve, now’s the time to talk strategy. Even a small dip in rates can save you thousands over the life of a loan.

📞 Call Krista Klause, your trusted Realtor, to discuss your options and make your next move with confidence in San Antonio, Helotes, Bandera, and beyond.

Categories

Recent Posts