Rent vs. Buy: The Equity Factor Explained by Krista Klause, Your Trusted Realtor

You might have caught headlines recently claiming it’s more affordable to rent than to buy a home 📰. At first glance, monthly costs in some markets do suggest renting could be lighter on your wallet. But, there's a critical piece often missing from this puzzle: home equity. Let’s dive into why this should be a key part of your decision-making.

📊 What the Headlines Show

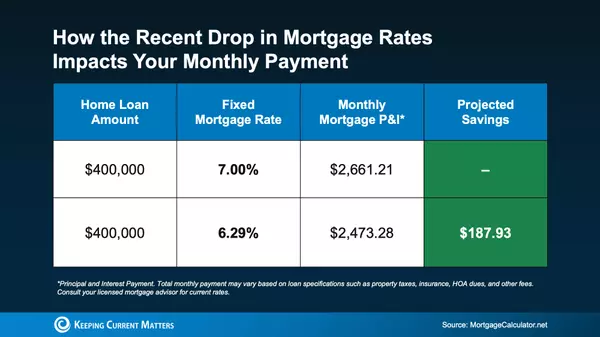

Data from Realtor.com and the National Association of Realtors (NAR) paint a straightforward picture: renting can appear cheaper, especially if you’re not seeking much space. For instance, the median monthly rent for 2 bedrooms is $1,889, compared to a median mortgage payment of $2,040 — just a $151 difference 📉.

🏡 The Equity Effect

Renting means your payments cover housing expenses and nothing more. Essentially, that money is not coming back. In contrast, every mortgage payment not only secures your shelter but also invests in your future. This investment increases as you build equity with each payment and benefit from rising home values 📈.

📈 Equity Growth in Action

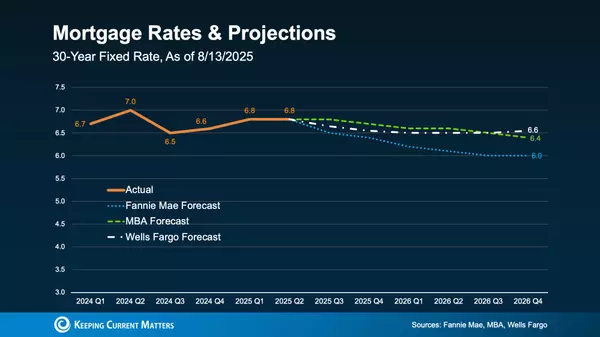

Consider this: Fannie Mae and Pulsenomics regularly survey over 100 experts about home price expectations. Their latest survey predicts continued price increases. For example, buying a $400,000 home now could grow your wealth by over $83,000 in five years, thanks to equity gains from projected home value increases 🏠💵.

💬 Renting vs. Buying

While renting might save you a few dollars monthly, you miss out on the equity that could significantly enhance your financial future. It’s crucial to weigh these options based on your financial situation. Purchasing might not work for everyone right away, but for those who can afford it, the long-term benefits of building equity shouldn't be overlooked.

🔑 Bottom Line

Buying a home offers benefits that renting cannot match — the opportunity to build equity and increase your wealth over time. If you're considering taking advantage of long-term home appreciation and want to explore your options, Krista Klause is here to guide you through every step. Talk to her today to see whether buying might be the right move for you! 🌟

By understanding all facets of the rent vs. buy debate, you can make a more informed decision. Remember, it's not just about monthly costs; it's about your long-term financial health and stability

Categories

Recent Posts