Understanding the Fed's Impact on the Housing Market with Realtor Krista Klause

Navigating the housing market in San Antonio? Realtor Krista Klause explains how recent Federal Reserve decisions affect your homebuying and selling plans. 🌟🔍

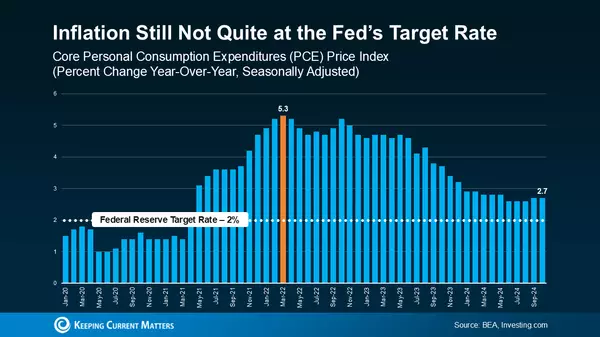

Federal Funds Rate and Inflation 📉🔬

- The Fed's aim to lower inflation led to increased Federal Funds Rates, indirectly influencing mortgage rates.

- Recent cooling of inflation has halted these hikes, with no increases since July.

Potential Rate Cuts in 2024 📊🔮

- The Fed's pause in rate increases and forecasted cuts for 2024 hint at an improving economy.

- This shift could lead to lower mortgage rates, enhancing affordability for buyers and sellers. 🏠💰

Mortgage Rates' Downward Trend 📉💲

- While influenced by various factors, mortgage rates are expected to continue decreasing in 2024.

- This trend could ease buyer affordability and encourage sellers to move.

Bottom Line 📌

Stay informed about the Fed's decisions and mortgage rates with Krista Klause, your trusted real estate guide in San Antonio. 📞🌟

Categories

Recent Posts

Mortgage Rate Stability Might Be the Opportunity You’ve Been Waiting For!

The Real Estate Shift: How the Housing Market Has Transitioned

Why Pricing Your Home Right Matters More Than Ever

Buyer's Market is Back: What Every Seller Needs to Know in 2025!

Homes Are Lingering on the Market—What Buyers & Sellers Need to Know!

Is Retirement on the Horizon? Unlock Your Home’s Hidden Goldmine!

Demystifying the Appraisal Process: What Buyers Need to Know

Unlock the American Dream: How VA Home Loans Make Homeownership Possible for Veterans

Understanding the Fed’s Role in the Housing Market

Navigating Today’s Housing Market with Confidence