Understanding the Fed’s Role in the Housing Market

With all the talk about the Federal Reserve (the Fed) and its impact on the housing market, it’s important to know what’s really going on. This week, the Fed meets to discuss the Federal Funds Rate—essentially, the cost for banks to borrow from one another. While this isn’t directly setting mortgage rates, it does influence them, so buyers and sellers should take note. Krista Klause and her team are here to help you break down how this affects you 📉💼.

What Drives the Fed’s Decisions?

The Fed considers three main economic indicators:

-

Inflation 📈

Inflation has been high recently, but it’s showing signs of stabilizing as it moves closer to the Fed’s 2% target. Lower inflation could lead to rate cuts soon, which may eventually ease mortgage rates too. -

Job Growth 💼

The Fed is monitoring how many new jobs are added each month, and the numbers are beginning to cool, which is exactly what the Fed aims for. Fewer jobs mean a slower economy, which could lead to rate cuts. -

Unemployment Rate

A strong labor market is reflected in a low unemployment rate of 4.1%, showing the Fed’s current strategy is balancing out well.

What’s Next for Mortgage Rates?

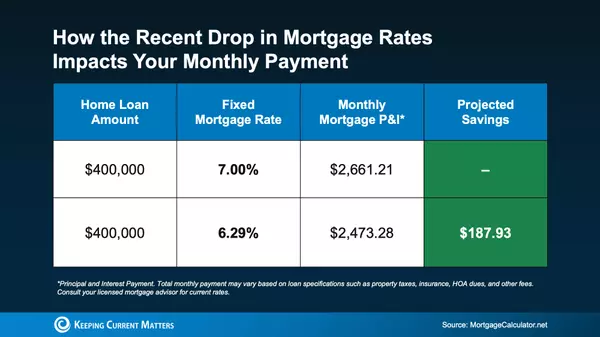

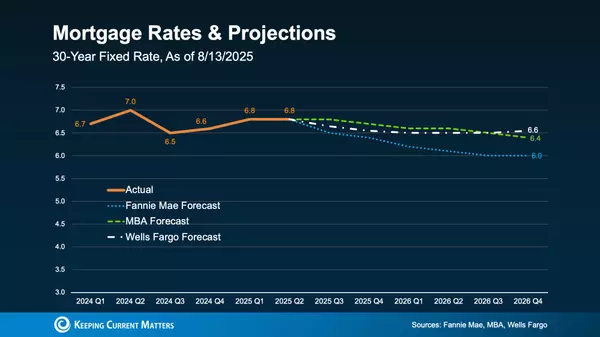

If the Fed lowers the Federal Funds Rate, mortgage rates could follow over time. Experts anticipate a gradual decline in rates as we move into 2024 and 2025, but it won’t happen overnight. Key economic events, including the upcoming presidential election, could still cause market shifts and impact rate trends.

Bottom Line 💬

While the Fed’s decisions are important, it’s economic data and market trends that truly drive mortgage rates. Partner with Krista Klause and her team to navigate this changing landscape and find opportunities as rates gradually stabilize. The journey may include some twists, but with the right team, you’ll have a trusted guide every step of the way!

Categories

Recent Posts